Building Pouppy 1.0:

Finance Made Relatable

Timeline2023

ClientPersonal

2 min read

Teenagers are often excluded from conversations about money — not just by regulation, but by design. Financial products are rarely built with their cognitive and emotional needs in mind.

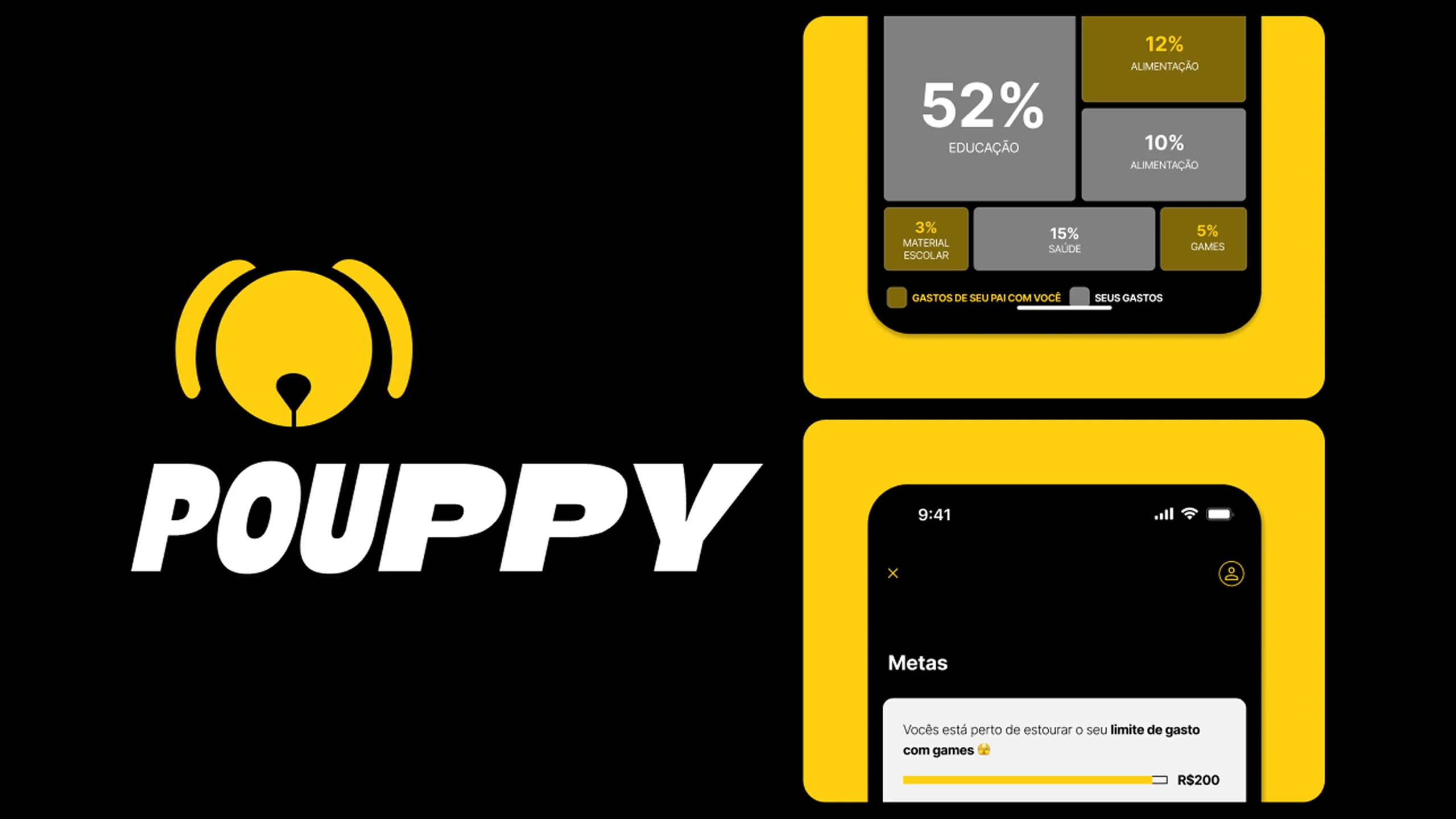

This project was an exploratory study to understand how a personal finance app could help teenagers build financial confidence, not just literacy. From behavioral insight to product structure, the goal was to shape something that felt relevant, intuitive, and trustworthy.

CHALLENGE

- How do you teach finance without making it feel like school?

- What does trust look like for someone just starting to handle money?

- How can UX reduce the anxiety often tied to financial decisions — even in small ones?

APPROACH

- Researched behavioral patterns and emotional needs of teenage users

- Identified moments of friction in existing youth finance platforms

- Mapped goals with parties that would be involved (parents, teenagers): education, autonomy, simplicity

- Developed user journeys that balanced guidance with independence

- Created a product structure focused on learning by doing, not passive explanation

IMPACT

- Shaped a product concept grounded in trust, not just function

- Delivered UX flows that support learning without overload

- Defined a tone and interaction style that respected the user’s intelligence

- Served as a strategic prototype for future development initiatives in the edtech/fintech space

WHAT I LEARNED

- Designing for teenagers is a practice of translation: not simplifying content, but reframing relationships

- Education can happen through rhythm, interface, and feedback — not just tutorials

- Trust is the real UX for financial tools